The Rise of Cryptocurrency: A Beginner’s Guide to Cryptocurrency Trading

In recent years, the world of cryptocurrencies has exploded in popularity, with millions of investors around the world trading and buying digital currencies. For those new to the field, navigating the complex world of cryptocurrency trading can be overwhelming. In this article, we’ll cover the basics of cryptocurrency, the airdrop (when the price of a coin suddenly drops), and provide an overview of pre-sale events.

What is Cryptocurrency?

A cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it is not controlled by any government or financial institution. The most well-known cryptocurrency is Bitcoin, but there are countless others, each with their own unique characteristics and use cases.

How Does Cryptocurrency Trading Work?

Cryptocurrency trading involves buying and selling digital currencies on online exchanges. Here’s a step-by-step overview of the process:

- Deposit Funds: You’ll need to fund your trading account with the desired amount of cryptocurrency.

- Choose an Exchange: Choose an online exchange that supports the currency you want to trade, such as Coinbase or Binance.

- Place an Order: Place a buy or sell order using a specified price and quantity.

- Execute the Trade

: The exchange executes your trade by sending the funds from your account to the seller’s account.

- Monitor Your Portfolio: Track your trades and adjust your portfolio as needed.

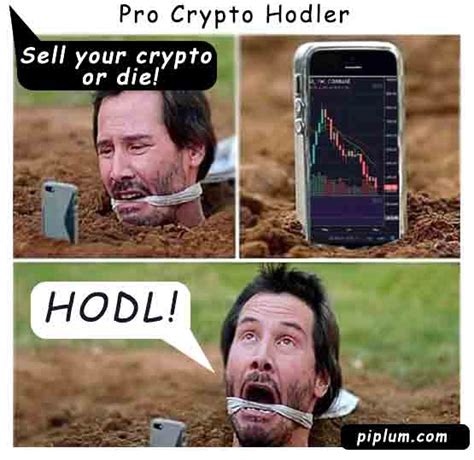

Dump: When the Price of a Coin Suddenly Drops

A cryptocurrency dump occurs when its price suddenly drops significantly, often due to market speculation or external factors such as regulatory changes. The most famous example is Bitcoin’s infamous “Black Thursday,” when the price dropped by over 10% in a single trading day in October 2013.

Factors Contributing to the Dump:

- Speculation: Investors may buy a coin expecting it to rise, only to have its price unexpectedly fall.

- Regulatory Changes: Changes in regulations or government policies can significantly impact the market.

- Market Volatility

: Cryptocurrency markets are known for their high volatility, making prices more susceptible to sudden price drops.

Pre-Sale Events: A Guide to Understanding Cryptocurrency Trading

A pre-sale event is a special opportunity offered by cryptocurrency projects before they go public. These events give investors a chance to buy at a discounted price and potentially benefit from early access to the project’s tokens or features.

Types of Presales:

- Whale Exits: Large buyers exit the market, driving prices down.

- Fundraising Campaigns: Projects raise funds for development, marketing, or other expenses from presale proceeds.

- Token Sales: Investors buy and hold tokens for a set period of time to take advantage of increased demand.

Presale Events: When to Participate?

- Look for Projects with Strong Development Teams: Established projects with experienced teams are more likely to succeed in the long term.

- Analyze the Project Roadmap: A well-planned project is more likely to deliver on its promises and avoid presale price manipulation.

- Understand Tokenomics: Understand the supply, demand, and potential use cases for the token.

Conclusion

Cryptocurrency trading can be a high-risk, high-reward game, but it requires careful research and planning. By understanding the basics of cryptocurrency, airdrops, pre-sales, and market fundamentals, you can make informed decisions about participating in this exciting space. Remember to remain vigilant, do your due diligence, and always put safety first when investing in cryptocurrencies.

Disclaimer:

This article is not a substitute for professional financial advice.